Learn how to split loan EMIs between co-borrowers using a calculator, with real examples and smart repayment strategies.

Sharing a loan often feels straightforward at the start. Trust is high, intentions are aligned, and the focus stays on getting the approval done. The complexity usually appears later, when the monthly repayment has to fit into two different financial lives.

Many people assume that splitting an installment is a simple arithmetic exercise. Divide it equally, set up standing instructions, and move on. What often gets missed is how different incomes, expenses, and risk tolerance quietly change how that split feels over time.

This mental gap between shared responsibility and individual comfort is where misunderstandings can slowly take shape.

Understanding the idea beyond simple division

When two or more people repay a loan together, the installment represents a shared obligation with individual impact. The same amount can feel manageable for one person and restrictive for another.

Thinking about splitting as a planning decision rather than a default rule helps align repayment with real financial capacity.

Why this calculation is commonly misunderstood

Equal division feels fair because it is easy to explain and avoids uncomfortable conversations. It appears balanced on paper and requires little thought.

This is where most people get surprised. What looks fair mathematically can feel unfair in practice when cash flows differ.

Why this matters for long-term decisions

Loan repayments extend across many months or years. A split that feels manageable initially can become stressful if income changes or new responsibilities arise.

Calculating different scenarios helps surface these risks early, before they turn into friction.

The effect of time and small changes

Small imbalances compound quietly. A slightly higher share paid consistently reduces flexibility and increases dependence on stability.

When you calculate it, the pattern becomes clearer. Even modest adjustments can improve sustainability over the long term.

A realistic shared repayment situation

Consider co-borrowers with uneven income growth. An equal split may work today but feel restrictive later.

Exploring alternative allocations provides insight. Numbers often reveal what assumptions hide when future uncertainty is acknowledged.

Common mistakes that create strain

- Choosing an equal split by default

- Ignoring personal expenses and obligations

- Failing to revisit the arrangement over time

- Relying on informal understanding instead of clarity

These issues usually arise from avoidance rather than lack of trust.

How this differs from standard loan planning

Most loan tools focus on total repayment and eligibility. Splitting focuses on individual experience within a shared commitment.

This perspective recognizes that affordability is personal, even when responsibility is shared.

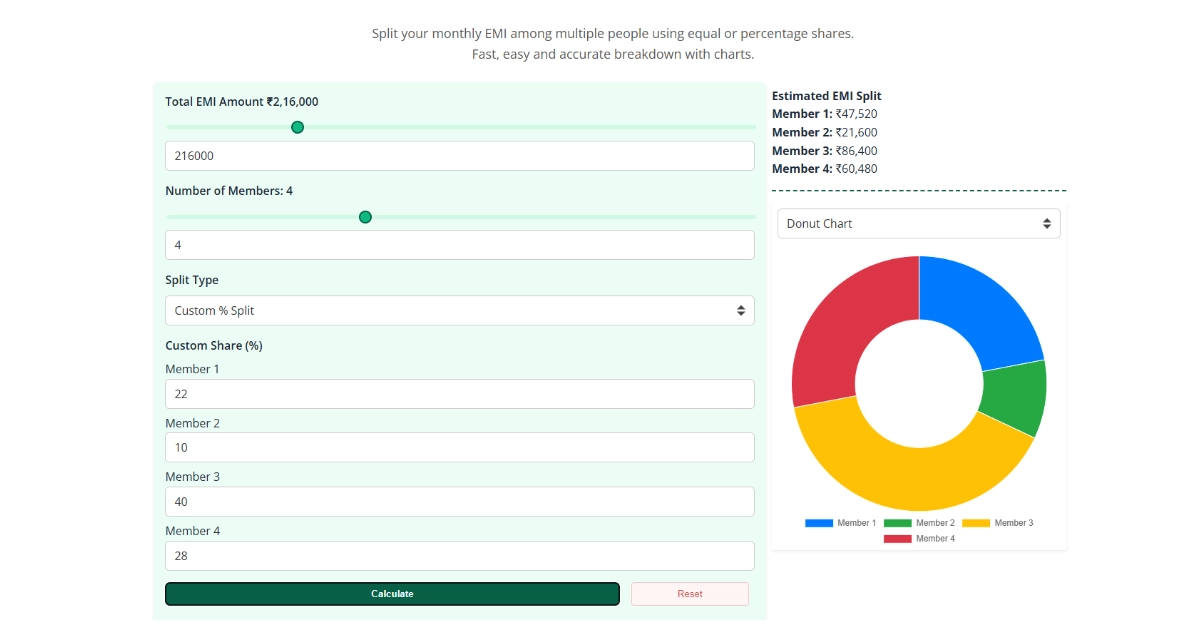

Using the calculator as a clarity tool

The calculator works best as a neutral reference point. Adjusting income-based or custom splits helps visualize how repayment pressure is distributed.

Clarity replaces assumption. Instead of debating what feels fair, outcomes become visible and easier to discuss.

The psychological side of shared responsibility

Clear structure reduces silent stress. When expectations are aligned early, trust remains intact through changing circumstances.

Confidence grows from shared understanding. Exploring different scenarios with the calculator encourages patience, supports better communication, and helps co-borrowers make decisions that remain comfortable over the long term.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying