Learn how a compound interest calculator works, with examples showing how your money grows over time through compounding.

Most people understand the idea of saving money. Very few truly understand how money multiplies. That difference is exactly where compound interest comes in. It is not a shortcut to wealth, but it is the most reliable mechanism through which money grows quietly, steadily, and predictably over time.

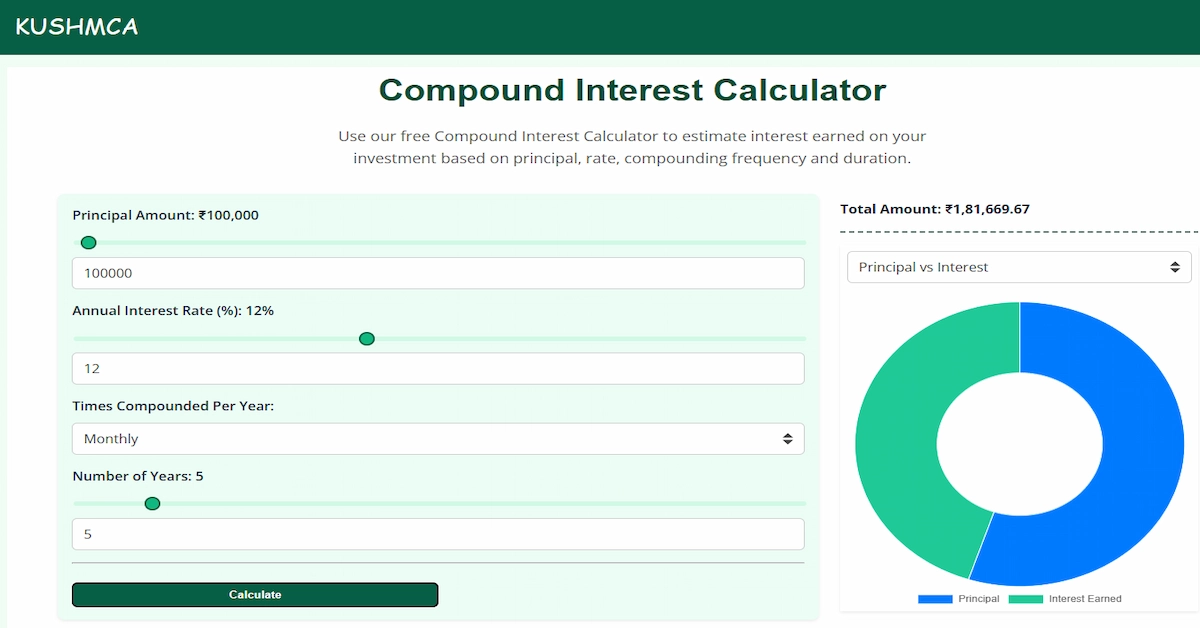

A compound interest calculator helps you visualize this growth with real numbers. Instead of guessing how much your savings or investments might be worth in the future, you can calculate outcomes based on time, rate, and consistency. This clarity is what turns vague financial goals into actionable plans.

What Is Compound Interest in Simple Terms?

Compound interest means earning interest not only on your original amount, but also on the interest that has already been added. Over time, this creates a snowball effect. The longer your money stays invested, the more powerful compounding becomes.

Unlike simple interest, where growth is linear, compound interest grows exponentially. In the early years, the difference feels small. In later years, it becomes dramatic.

This is why time is more important than timing when it comes to long-term wealth building.

Why a Compound Interest Calculator Matters

Many people underestimate compounding because the math is not intuitive. A compound interest calculator removes guesswork and shows exactly how small decisions today affect future outcomes.

- It converts abstract percentages into real money values

- It shows the impact of time, not just returns

- It helps compare saving vs investing scenarios

- It supports better financial decisions with data

Instead of relying on assumptions, you can see how money actually behaves.

How Your Money Grows Over Time (What Most People Miss)

The most important insight from a compound interest calculator is not the final amount. It is the curve of growth.

In the first few years, growth feels slow. This is where many people lose patience and stop investing. However, compounding does most of its work in the later years. The real acceleration happens when interest starts earning interest consistently.

This is why starting early matters more than investing large amounts later.

Let’s Look at a Practical Scenario

Imagine you invest a fixed amount and leave it untouched. For several years, the growth may look modest. But as time passes, the same rate of return begins generating much larger absolute gains.

When you use a compound interest calculator, you will notice something important: a significant portion of the final value comes from the last few years, not the first few.

This is the compounding advantage most investors ignore.

How Interest Rate and Time Work Together

People often focus only on getting higher returns. While returns matter, time plays an even bigger role.

- A moderate rate over a long period can outperform a high rate over a short period

- Consistency reduces dependency on market timing

- Longer horizons reduce the impact of volatility

A compound interest calculator helps you experiment with these variables safely, without risking real money.

Common Mistakes People Make With Compounding

Despite its simplicity, compounding is often misunderstood. Some common mistakes include:

- Stopping investments too early

- Constantly withdrawing gains

- Chasing short-term returns instead of staying invested

- Underestimating the value of consistency

Using a calculator regularly helps reinforce disciplined behavior by showing long-term consequences.

Compound Interest vs Other Growth Methods

Not all growth methods behave the same way. Simple interest grows at a fixed pace. Compounding accelerates over time. One-time investments grow differently from periodic investments.

This is why compound interest calculators are often used alongside SIP, CAGR, or EMI calculators to compare strategies and outcomes.

The goal is not to pick the “best” method, but to understand which approach aligns with your financial goals and time horizon.

How to Use a Compound Interest Calculator Effectively

To get meaningful insights, avoid unrealistic inputs. Use conservative rates and longer time frames. Focus on consistency rather than perfection.

Ask questions like:

- What happens if I stay invested longer?

- How much difference does an extra year make?

- What if I increase my contribution slightly?

The calculator is not just a tool. It is a decision-making aid.

Why Compounding Supports Long-Term Financial Stability

Compounding rewards patience and discipline. It reduces dependency on constant decision-making and market predictions. Over time, it builds a financial buffer that supports flexibility and confidence.

This is why long-term investors, retirement planners, and disciplined savers rely heavily on compound interest-based strategies.

Final Thought: Numbers Create Confidence

Financial stress often comes from uncertainty. A compound interest calculator replaces uncertainty with clarity. When you understand how your money grows, decisions become easier and emotions play a smaller role.

Instead of guessing where you might end up, calculate it. Numbers do not guarantee outcomes, but they dramatically improve the quality of decisions.

Use the calculator above to explore scenarios, test assumptions, and build a plan that works for your timeline.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying