Learn how an RD ladder calculator helps you create a staggered recurring deposit strategy for better liquidity and returns.

Saving regularly feels responsible, yet many people experience a quiet frustration along the way. Money gets locked for long periods, emergencies appear unexpectedly, and access to funds rarely aligns with when they are actually needed.

A common assumption is that consistency alone solves this problem. As long as deposits are made on time, the plan must be sound. What often gets overlooked is how timing of maturity affects flexibility and peace of mind.

This gap between disciplined saving and usable liquidity is where confusion begins.

Understanding the idea in simple terms

A staggered savings approach spreads maturity dates across different periods instead of clustering them at one endpoint. Rather than waiting for everything to mature at once, portions of savings become available at regular intervals.

This structure turns saving into a flowing system rather than a locked container. Each deposit still earns interest, but access becomes more predictable and practical.

Why this approach is often misunderstood

Many people see recurring deposits as uniform blocks. Once started, they assume all contributions behave the same way and mature together.

This is where most people get surprised. Staggering does not require higher savings or complex products. It is simply about organizing time more thoughtfully.

Why this calculation matters for real planning

Liquidity is as important as returns. A plan that looks strong on paper can feel restrictive if funds are inaccessible when needed.

Using a structured calculation makes it easier to align maturity timing with likely expenses, opportunities, or reinvestment goals. Clarity replaces guesswork.

The role of time and small adjustments

Minor shifts in start dates or tenures can change when funds become available without altering monthly commitment. Over time, these adjustments create a rolling cycle of access.

When you calculate it, the pattern becomes clearer. Time, not amount, does most of the structural work.

A practical saving scenario

Imagine someone saving for multiple medium-term goals while also wanting emergency flexibility. Putting everything into one long deposit creates rigidity.

Breaking the same effort into staggered deposits creates breathing room. Numbers often reveal what assumptions hide when timing is mapped realistically.

Common mistakes that reduce effectiveness

- Starting all deposits at the same time

- Choosing identical tenures without considering access needs

- Ignoring reinvestment timing after maturity

- Overcomplicating the structure unnecessarily

These issues usually arise from treating saving as static rather than dynamic.

How this differs from other saving methods

A single recurring deposit emphasizes discipline. A lump-sum deposit emphasizes returns. A staggered approach balances both while adding flexibility.

This balance makes it particularly useful for people who value access alongside steady growth.

Using the calculator as a planning aid

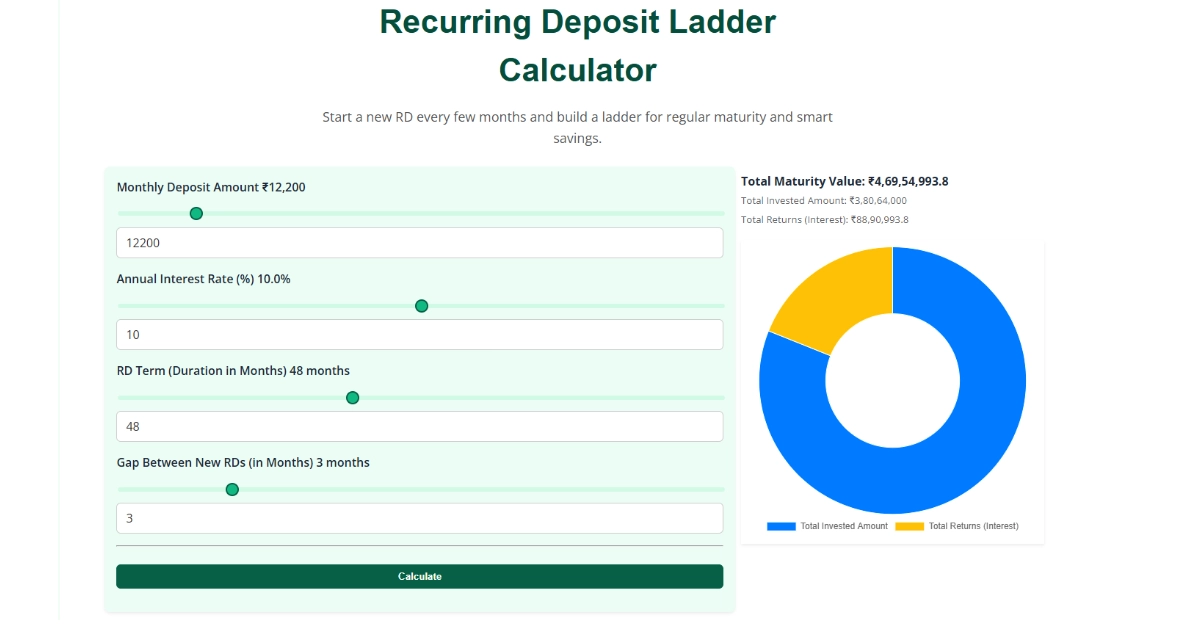

The calculator works best when exploring different start points and tenures. Adjusting these inputs helps visualize how maturity flows over time.

Exploration turns abstract planning into something tangible. It becomes easier to design a structure that fits real life rather than ideal assumptions.

The behavioral side of staggered saving

Regular access points reduce anxiety. Knowing that funds mature periodically makes it easier to stay committed without feeling locked in.

Clarity builds confidence. When savings are structured with intention, patience improves and decisions feel calmer. Trying different scenarios with the calculator reinforces long-term thinking and supports a savings plan that feels both disciplined and flexible.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying